If you need an efficient, easy-to-use and free Excel template for personal budget or personal finance, you have come to the right place.

Managing personal budget and finances are the necessary actions that help you save money. However, managing personal finance or budget could be tricky when you have many things to take care of at work and home.

This article rounds up the best Excel templates that are also free to download. Continue reading to learn how these spreadsheets will help you save more through smart budgeting.

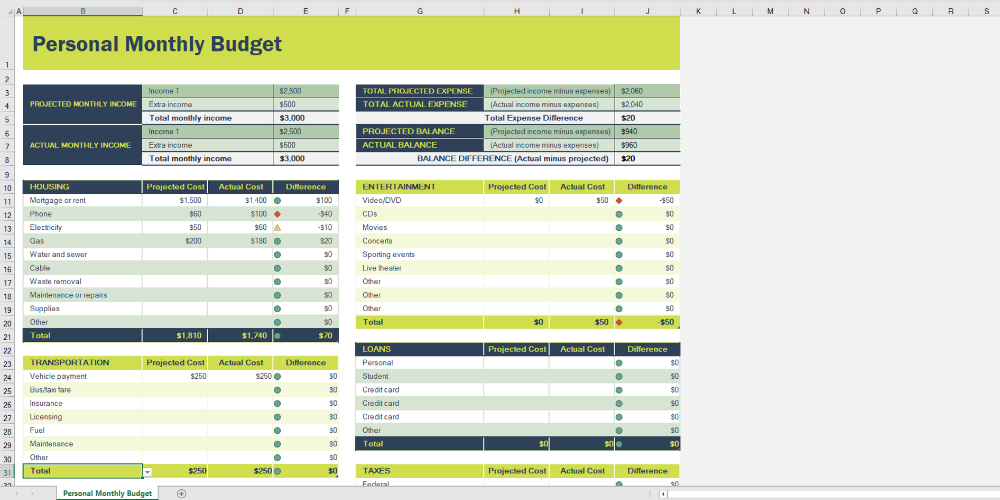

If you’re looking for an elaborate budgeting template for personal use, you should definitely try the Personal monthly budget spreadsheet template. It lets you streamline how to utilize your monthly income throughout the month for maximum savings. The template is also truly user-friendly since you don’t need to make too many edits.

The spreadsheet comes with multiple expense headers that most households need to manage every month. For example, you can budget housing, transportation, insurance, food, pets, personal care, and so on. There are also two separate fields of income like primary and secondary sources.

The Excel template also compares projected and actual expenses with projected and actual incomes. You also get personalization opportunities since the template offers editable subcategories. You can keep a copy on your Microsoft OneDrive account for online editing and get a printed copy for offline usage.

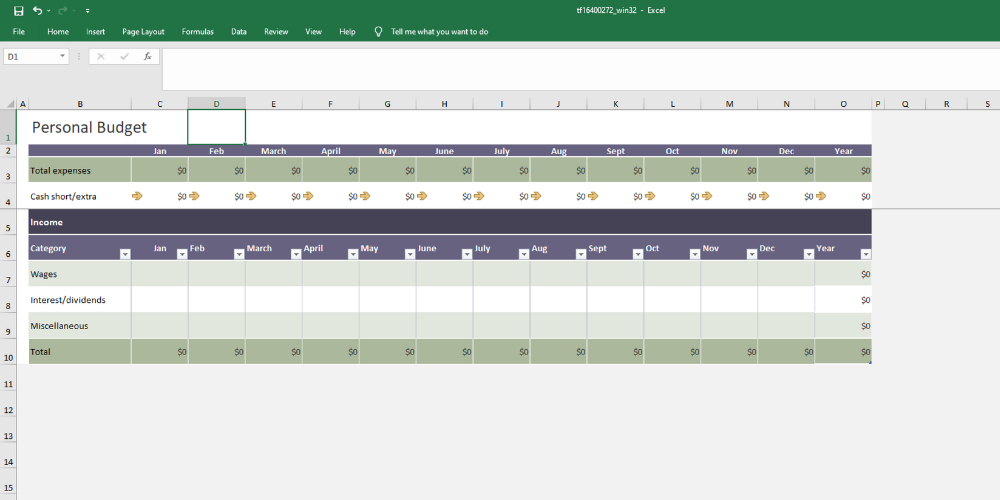

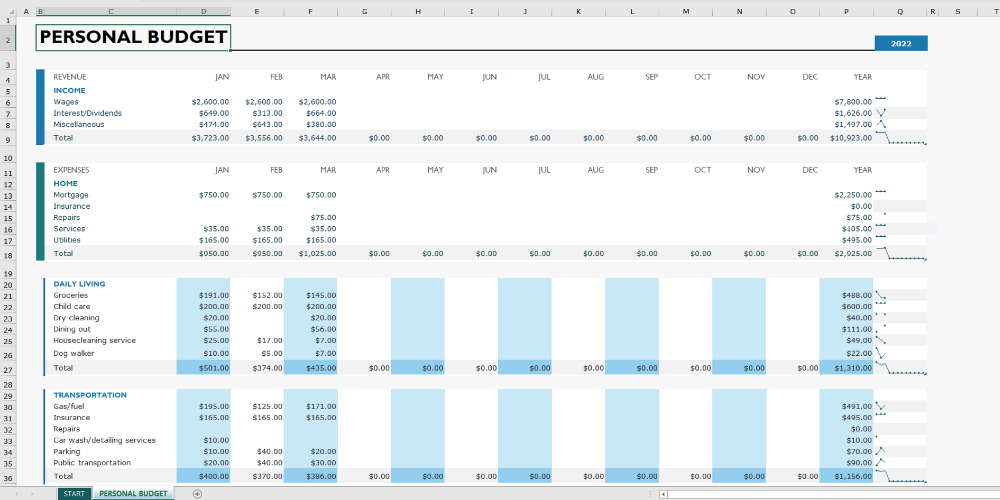

The Basic personal budget spreadsheet helps you analyze complete yearly income and expense data. This personal budgeting tool is also equally useful if you need to manage the spending of any small project. When you get a clear picture of the ongoing or previous year’s annual transactions, you can find more areas of cost-cutting.

The template is free for anyone to download. It works well with desktop Excel software or Excel online. The Excel workbook comes with two dedicated Excel worksheets like Summary and Expense. You need to enter all expenses in the Expense tab and incomes in the Summary tab.

Monthly expense vs. cash status will automatically show up in the Summary worksheet. The expenses section has standard categories and subcategories that you might need to budget. Moreover, the template offers easy sorting and filtering.

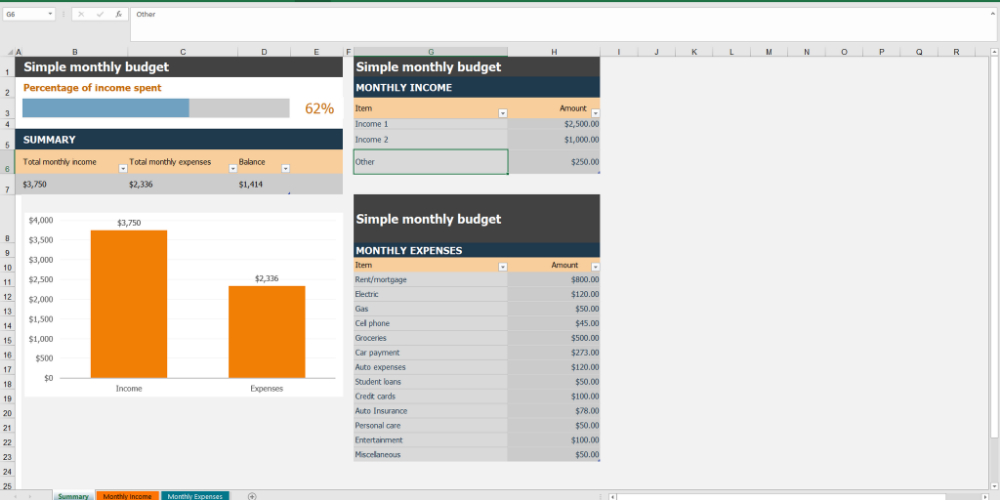

If you want to know how you spend and what you earn, you can try the Easy monthly budget template of Excel. It also lets you visualize the nature of spending, like the items on which you spend most. If you’re planning for short-term or long-term goals, there is no better way to manage personal finances than using this free spreadsheet template.

Its Summary worksheet shows you a comprehensive picture of monthly income, total monthly expenses, and savings. A vertical and horizontal bar chart gives a sleek dashboard-like view.

You can use the dedicated income and expenses worksheet for transaction data entry. The expenses tab comes with popular expense heads. But, you can edit them or add new rows as per your requirements.

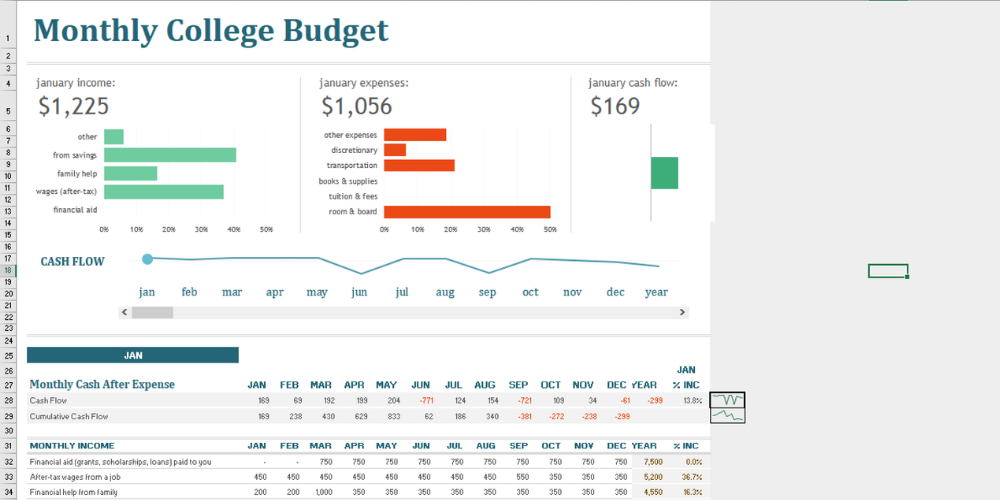

Keeping track of personal expenses is vital during college days since you can easily get carried away with distractions and spend more than you want. The Monthly college budget is a free Excel workbook that you can download for a desktop app. You may also upload it to your OneDrive account for online access print it out for manual budget tracking.

If you’re a parent of a college-going child, you can personalize this Excel sheet according to your child’s needs. Parents and children can share the sheet for a better understanding of expenses.

Expense management is effortless since you only need to enter the transaction amounts in the appropriate fields. The template has graphs, Sparklines, and slick sliders that turn personal budget into a fun activity.

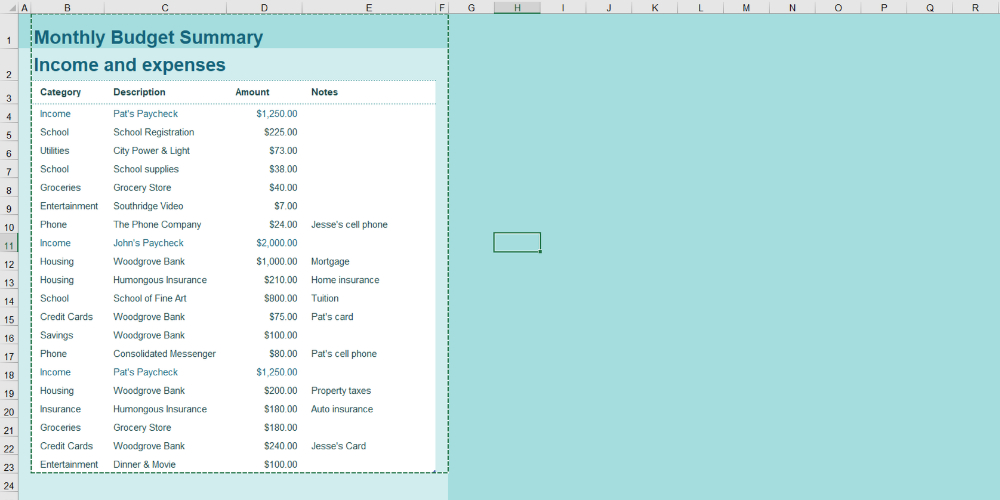

Budget calculator is an easy-to-use tool to manage your expenses and income monthly in Excel desktop app, Excel online, and offline format. The template comes with editable cells to customize the expense and income headers. The template is suitable for a month’s budgeting. For the next month, simply duplicate the worksheets.

The income and expenses transactions data-entry sheet is similar to the manual notepad-based budget tracking. You can write down cash inflows and outflows in one list. When you need to add a new cash outflow header, simply enter it under the Description column and select a category under the Category column.

Simple personal budget Excel worksheet lets you discover an in-depth pattern of your personal finances. It is the perfect tool to track monthly expenses and incomes effortlessly from work or home. Upload a personalized version in your OneDrive account for easy access via a mobile phone, computer, or tablet.

The template is particularly appropriate if you’re looking for a one-page view of all of your expenses and incomes. There are embedded formulas in the dedicated cells to calculate yearly and monthly totals.

There are Sparklines beside each income or expense header for data visualization and analytics. You might want to try this template instantly if you’re going to save money for a future goal or control your expenditure in a better way.

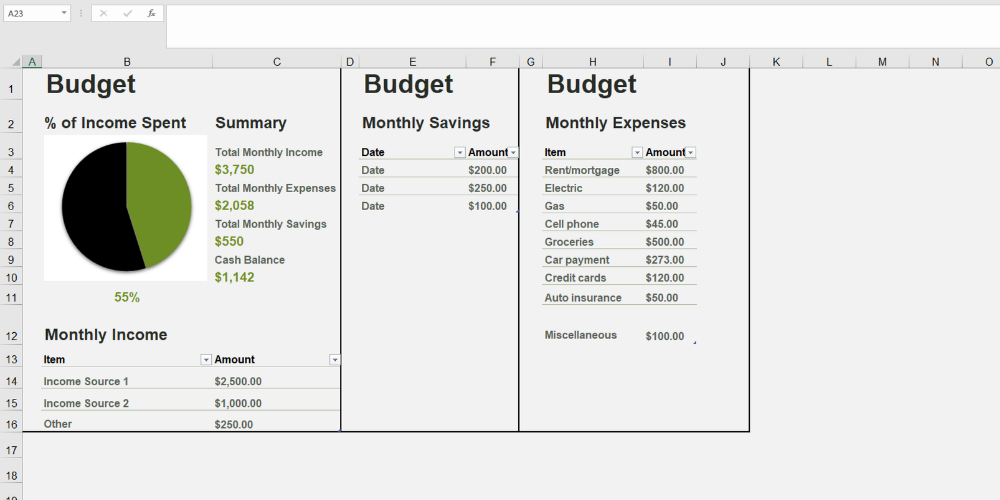

Manage my money is another quick personal budget-tracking spreadsheet for Excel. You need to make copies of it for every new month since it is a monthly tracker. A great attraction of this workbook is a pie chart-based dashboard that gives you a 360° view of transactions like incomes and expenses.

The template compares income with expenses and generates savings figures. Therefore, you need to enter cash inflows into the Monthly Income tab and cash outflows into the Monthly Expenses worksheet. In the end, you get a one-spot view of income, savings, and expenses. You also can visualize cash balances from the dashboard.

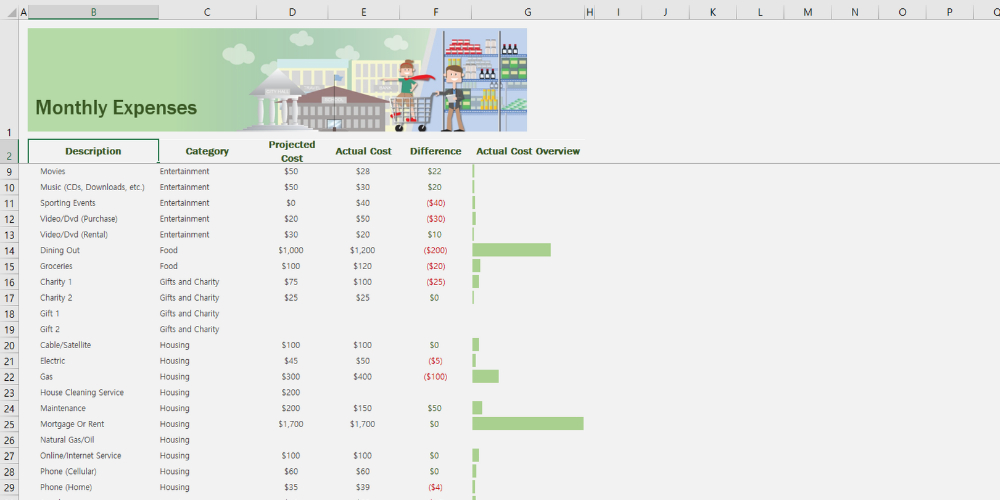

Do you want to manage the monthly family budget the right way? You can download the Household monthly budget template for free and get started instantly. Its overview tab gives a clear view of balance, income, and expenses. You’ll also see a category-wise breakdown of expenses just below the summary dashboard.

The Excel template comes with more than 50 expense headers. Thus, there is a lesser chance that you need to enter any manual cash outflow headers since the existing list covers all. Simply adjust the Projected and Actual Cost headers in the Monthly Expenses worksheet to start tracking expenses.

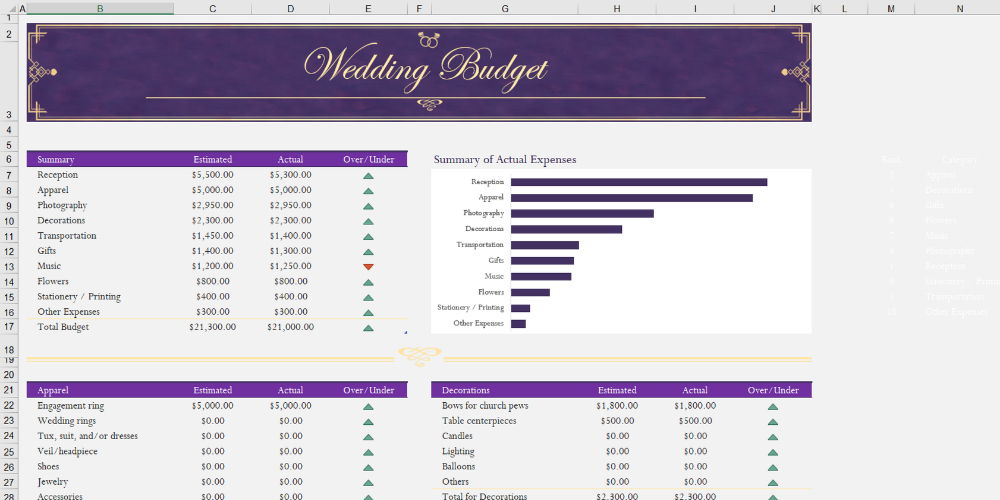

Wedding planning is a major project for anyone, and thus there should be a streamlined wedding budget planner as well. You can try the Wedding budget template for Excel to visualize all the expenses in real-time. Also, you can modify the fonts and table colors to match the expenses planner with your wedding theme.

It is a budgeting tool that shows you all the cost headers in a single window. Simply scroll down to find out all expenses. The tables also give you a visual cue whether you’re going above or below your wedding budget.

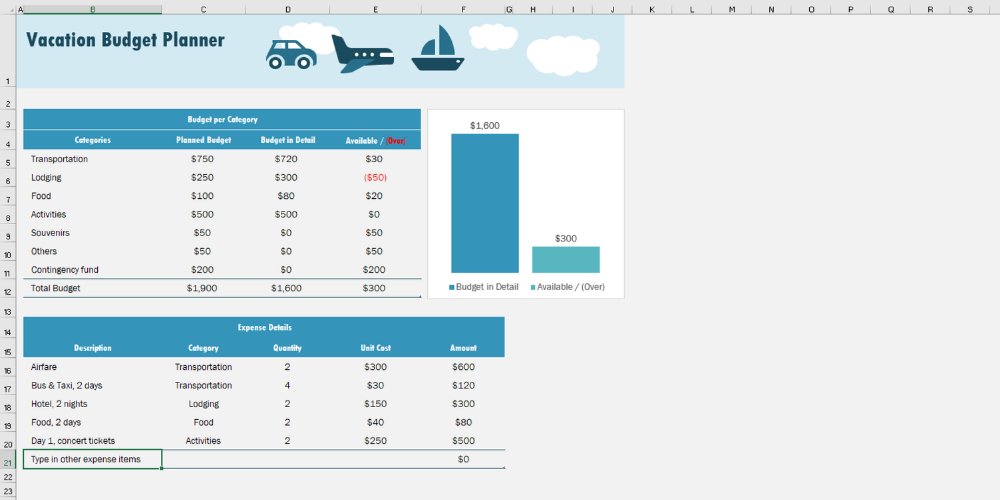

Ensure you’re traveling with adequate cash and not going beyond your budget by using this simple Vacation budget planner tool for Excel. It is essentially a spreadsheet with common travel expenses headers like airfare, lodging, transportation, and many more.

There are two tables in this Excel worksheet. The first one visualizes the broad categories like transportation and lodging. The second table deals with subcategories that come within the main expense headers. You can also add unique cash outflow headers.

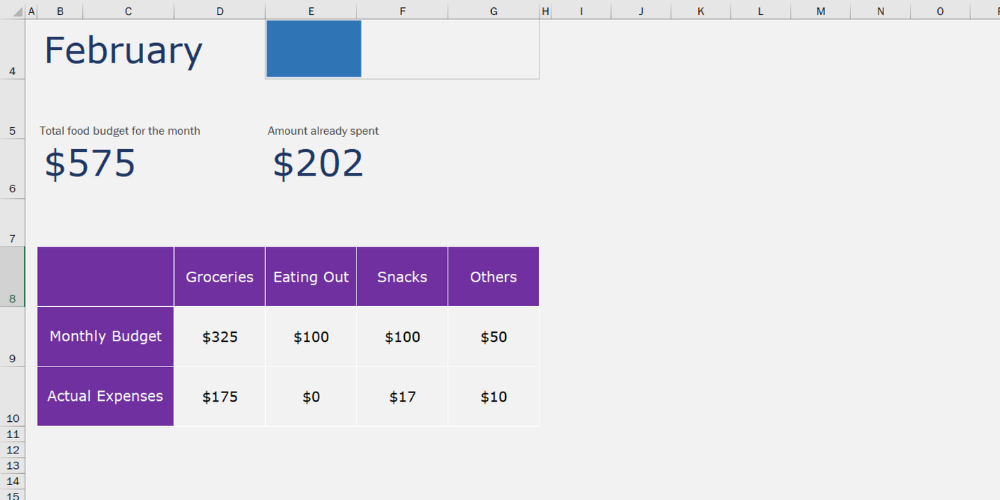

Sometimes you need to focus on a specific expense header like the monthly budget for food, entertainment, or shopping. It helps you with a granular view of particular spending that often goes beyond the budget. Use Monthly food budget for worry-free budgeting.

At the beginning of the month, enter a budget. Then, start entering the food purchases into the expenses tab to track your expenditure on groceries. You may also rename the text box beneath the image header to change the food budget to something else.

Next, let’s learn a little bit basics of managing a personal budget in a spreadsheet.

An Excel template for personal budget is essentially a spreadsheet file. It contains all the columns, rows, headers, formulas, and styles, so you don’t need to invest time in formatting. All you need to do is upload the file to your OneDrive and track your personal finances.

A template also allows you to customize the data headers, add or delete rows/columns, and format the worksheet style. You can get a template based on how granular data you want, like bi-weekly, monthly, or yearly budget.

All the templates mentioned below will let you download an Excel file to the computer or open the template in the browser for online tracking.

The advantages of tracking your personal budget on an Excel sheet are as follows:

Data Privacy: Excel templates are reliable and safe since you don’t need to enter your personal finances on a third-party website or app. You retain your data to yourself, so no worrying about data theft.

Anytime Access: You can keep a copy of the file on your desktop computer and upload the same to OneDrive. Excel will automatically update the online file whenever you make any changes on your desktop computer. Moreover, you can access the workbook on your Android or iOS devices since you can get an Excel mobile app for free.

Let’s now look at the free templates for personal budgeting in Excel:

The above-mentioned free Excel templates should cover all of your personal budgeting needs. Depending on the scenario, like a family budget, food budget, child’s college expenses, you can pick any free Excel template and start saving money.