Overtime Calculator Template with Payslip in Excel, OpenOffice Calc & Google Sheet to calculate overtime pay for hourly and salaried employees.

Moreover, this template helps you to calculate time and a half as well as double pay overtime. Additionally, you can print weekly, bi-weekly, and monthly payslips for employees with overtime.

Table of Contents

We have created a simple and easy Overtime Calculator Template with predefined formulas and functions. Just insert a few details and it will calculate the overtime for hourly as well as salaried employees.

Download your desired format and start using it.

Feel free to contact us for the customization of this template as per your requirement. We also design new templates based on your needs. You can hire us for our services on Fiverr or directly contact us at info@msofficegeek.com.

Overtime pay is the incremental amount that an employee pays to the employee for working additional hours in a workday or workweek.

The above definition applies to both hourly employees as well as salaried employees. Although the calculation methods differ for both.

In simple terms, overtime pay is the pay for working the excess of hours worked beyond the standard timings. Working overtime is very common and in some industries, it is even mandatory.

Generally, employees in construction, IT, manufacturing, etc industries often need to work overtime.

Governments design labor laws to prevent employees from being forced to work long overtime hours. Moreover, These laws and regulations define amicable compensation for overtime.

Overtime can be beneficial for both employee and employer. Employers get extra workforce recruiting extra staff.

Moreover, it saves the cost of training and managing new staff. Employees also get some extra income. Doing this is effortless because the activities performed are generally the same.

In general, most businesses follow the following rule: 8 hours a day and 40 hours per week. Anything exceeding this is overtime.

Employers define regular hours based on industry standards, employment contracts, etc. By law, these regular hours must follow national as well as state laws.

In the US, overtime is governed under the Fair Labor Standard Act (FLSA).

The overtime rate is applicable on the basis of days and hours of the workweek. As per the law, there are two types of overtime rates: Time and Half and Double.

As the name says, it is 1.5 times the regular wage. F0r example if the regular pay rate of the employee is $25 per hour then his overtime rate per hour will be $25 X 1.5 = $37.50.

This overtime rate is applicable under the following:

Under this rate, the employee is paid double the rate. F0r example if the regular pay rate of the employee is $25 per hour then his overtime rate per hour will be $25 X 2 = $50.

This overtime rate is applicable under the following:

Overtime Pay = (Regular Rate X Overtime Rate Multiplier) X Overtime Hours

Where:

Regular Rate = General hourly rate.

Overtime Rate Multiplier = Time and half or Double

Overtime Hours = Additional hours worked above 8 hours per day or 40 hours per week.

Many industries have different work hours per day or week. It can be either be 9 or 10 hours per day or 48 – 50 hours per week.

Overtime Hours = Total Hours Worked – Regular hours (per day or per week)

Follow the below-mentioned steps to calculate overtime pay for salaried employees:

Step 1

Calculation of overtime for salaried employees is different. First of all, to convert the monthly salary to per day salary divide it by 30 days.

Per Day Salary = Monthly Salary / 30 Days

Step 2

Now, divide per day salary by regular hours to get the regular hourly rate.

Regular Hourly Rate = Per Day Salary / Regular Hours

Step 3

Choose the multiplier and then multiply it with the regular hourly rate to get the overtime rate.

Overtime Rate = Overtime Multiplier X Regular Hourly Rate

Step 4

Sum up the overtime hours worked and multiply with

Overtime Pay = Overtime Hours X Overtime Rate

Overtime Calculator Template With Payslip template consists of 3 sheets: Overtime Calculator, Weekly Payslip, and Monthly Payslip.

It consists of two calculators: Overtime Calculator For Hourly Employees and Overtime Calculator for Salaried employees.

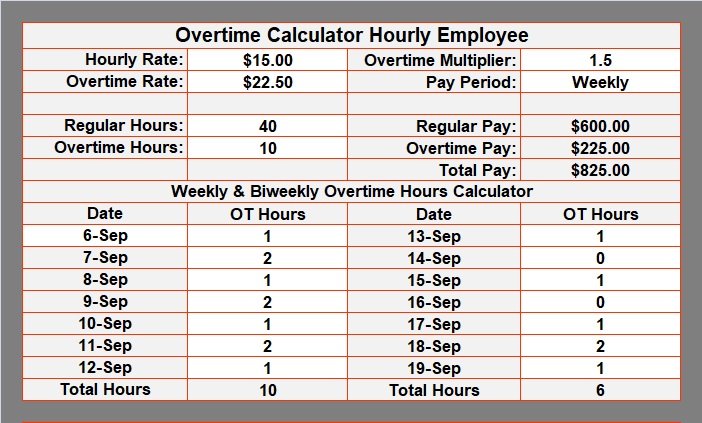

Overtime Calculator for Hourly Employees consists of the following heads:

Hourly Rate

Overtime Multiplier

Overtime Rate

Pay Period

Regular Hours

Overtime Hours

Regular Pay

Overtime Pay

Total Pay

As you insert the hourly rate and select the multiplier from the dropdown list, it will display the overtime rate. Select the pay period from the dropdown list.

Insert regular hours and overtime hours worked by the employee. To calculate weekly or biweekly overtime hours insert the date and overtime hours against the respective date.

The template will automatically calculate the total pay of the employee. Your work is almost done.

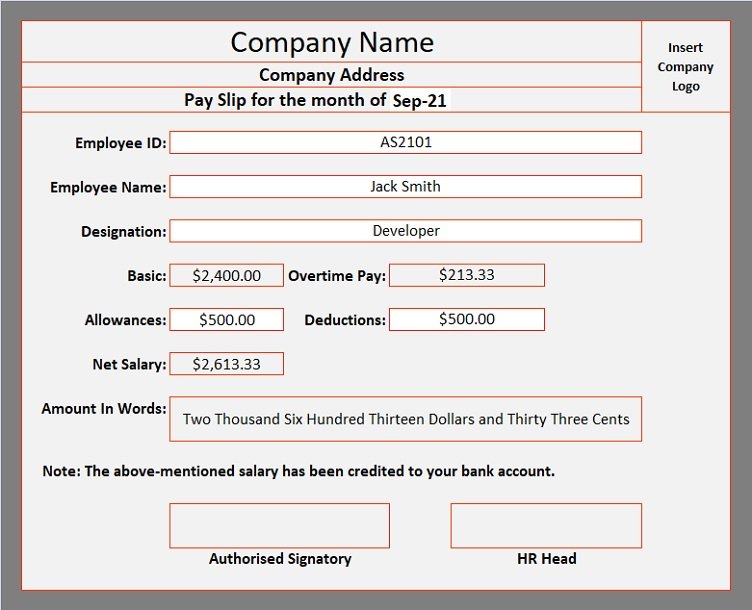

Now navigate to the Weekly-Biweekly Payslip sheet. Insert allowances and deductions applicable to the employee. All the remaining details the payslip will fetch from the overtime calculator.

Insert company name and logo and print the weekly/bi-weekly payslip for the employee.

If you want to manage overtime for multiple employees you can use our Timesheet. You can manage timecards for more than 20 employees with this timesheet.

Click the link below to download the template:

Overtime Calculator for Salaried Employees consists of the following heads:

Monthly Salary

Daily Salary

Regular Hours

Hourly Pay Rate

Leaves

Regular Pay

Overtime Multiplier

OT Pay Rate

Overtime Hours

Overtime Pay

Total Pay

Enter monthly salary and it calculates daily salary. Insert regular hours and it calculates the regular hourly rate. If employees have taken any leave, then insert the number of days. This will deduct the leave from the monthly salary and display the regular pay.

Select the overtime multiplier and it calculates the overtime rate. Insert sum of overtime hours during the month. It calculates the overtime pay. Total pay is the sum of regular pay and overtime pay. Your work is almost done.

Now navigate to the Monthly Payslip sheet. Insert allowances and deductions applicable to the employee. All the remaining details the payslip will fetch from the overtime calculator.

Insert company name and logo and print the monthly payslip for the employee.

There are few types of employees that are exempt from overtime as per the law.

Exempt employees must have the following characteristics:

Generally, salaried employees to be classified as exempt are in this category are executives, administrative employees, and working professionals.

An outside salesperson is also considered an exempt employee. They must possess the following:

Other job-specific exempt categories are babysitters, caretakers of the elderly, fishermen, employees indulged in fruit & vegetable transportation, local delivery drivers, newspaper delivery, police officers in departments with less than five officers, railroad employees, seamen on vessels, and taxicab drivers.

An employee whose job hours fall through a meal break must therefore be paid for the meal break.

An employee who can be called back on work by the employer on short notice is entitled to on-call overtime.

Those tasks which are an integral and indispensable part of the job then it is counted as “hours worked”. Thus, they are entitled to overtime.

If you like this article, kindly share it on different social media platforms. So that your friends and colleagues can also benefit from the same. Sharing is Caring.

Moreover, send us your queries or suggestions in the comment section below. We will be more than happy to assist you.