While leasing provides a viable option for those who aren’t ready to build down roots and purchase a property to have a house they can call their own, literally and figuratively, homeownership can help people who are looking for a longer tenure while they develop their careers in their blue-collar jobs in the United States’ busiest cities.

Real estate today is an industry made up of the various aspects of property; selling, leasing, development, appraisal, marketing strategy and even the management tasks associated with the lease or ownership of residential, commercial, industrial and agricultural properties. You may also see sample investment templates.

sanjosepby.org

File Format

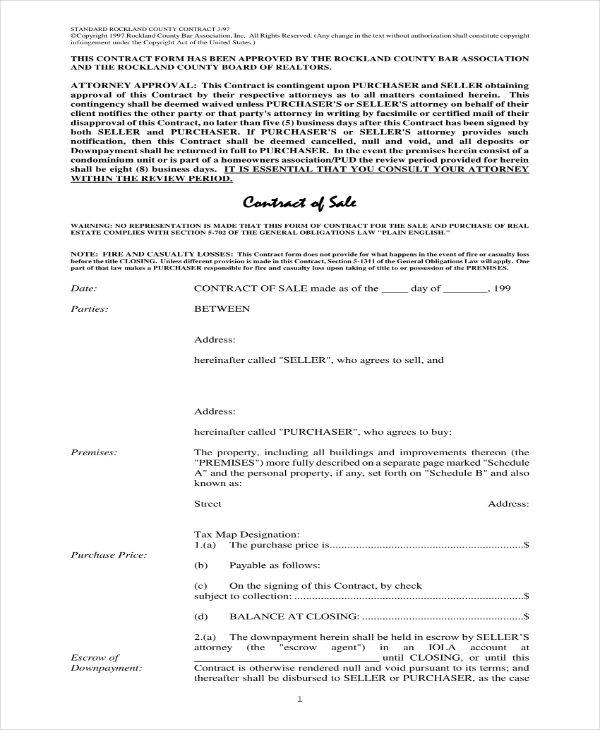

rocklandbar.org

File Format

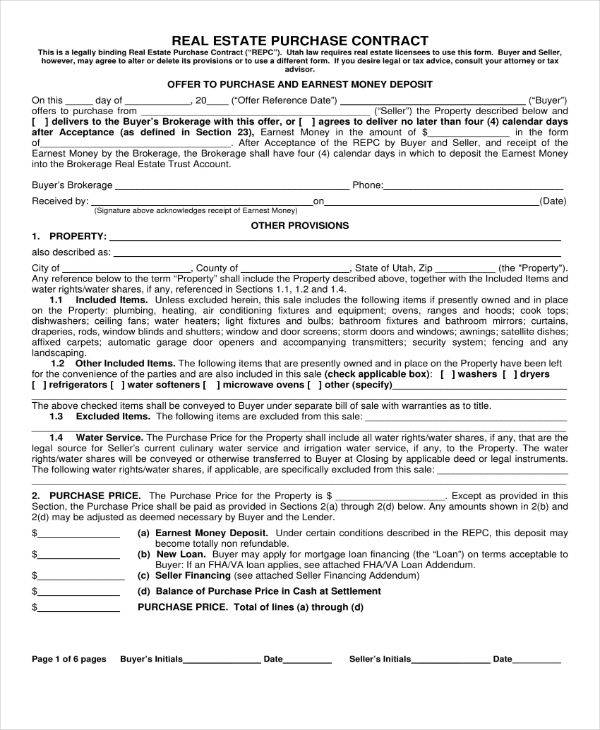

realestate.utah.gov

File FormatIf you’re new to the real estate business and have only just decided to invest in it, you’ll soon discover that there’s so much to learn before you put in your hard-earned money in a property. For one, what happens in the economy and issues of national concern greatly impacts the market’s rise and fall. Fortunately, one thing remains obvious. Real estate is here to stay and will continue to be generally stable because people need homes. Simple as.

Then again, maybe not, because investing in real estate is much more complex than stock investment in terms of its financial, legal aspects and the amount of diligence required to get it done right. This is why it’s better to have a good understanding of what investment means before purchasing your first property or signing an investment agreement.

Besides, being educated about real estate investment would give you a better chance of understanding the terms and conditions in a sample agreement. You won’t just be signing another paper. It could cost you years of hard-earned money if you sign something you don’t understand. You should learn how things work to ensure a smoother, albeit not perfect transaction.

When it comes to selling, the real estate isn’t that different from other businesses. Part of belonging to a very dynamic market involves the changing regulations in different states such as coding requirements before you can secure property investments. In some cases, sales are fixed and rates are non-negotiable. Like most business deals a wise investor should know that a well-drafted, clearly-defined real estate investment agreement also takes proper planning before it is finalized.

One of the takeaways for investors is that Uncle Sam provides significant tax benefits for real estate investors. The best benefit perhaps is arguably the depreciation write-off which comes in the form of a tax deduction when you are buying a property that includes a facility or building. To get better acquainted with this benefit, you may need the advice of your accountant although generally, you’re expected to depreciate a residential property over 27 years old and a commercial one which is over 39 and a half years.

Just remember that the IRS considers your real estate investment transactions as a business which means you’re able to claim the basic and necessary deductions that your average businessmen take. This includes insurance, maintenance costs, and mortgage among others. For the specifics, you may again need the help of your local tax advisor. You may also see simple investment agreements.

As we have previously mentioned, it’s a good idea to familiarize yourself with the fundamentals of real estate investment:

It’s been said a thousand times but something is just nice they need reminding twice. Location matters. This couldn’t get any truer than in the real estate industry. The location should be a top priority in your investment before forking down dollars by the thousands resulting in heavy debt over a property that isn’t marketable because of its location, on top of everything else. You can’t just pay for a property with cutting edge design located outside city limits when you intend to use to for business. Look for what might look like a rundown building on the best street in a suburban town or a fairly big city. You may also see investor agreements for restaurants.

You’ll soon learn that this is one of the most valuable principles in real estate. “Location matters,” is something that would never really get old. Your property is only as good and as valuable as where it is located. Consider access to work and play, public transport, entertainment and, recreation and of course, food. The environment where your property is could either have a good or bad impact, depending on its surroundings. You could easily have a nice house with minimal renovations needed but it wouldn’t hold much value if it’s in the ghetto. Always choose the best location. You may also see investment summary templates.

Although it’s more complicated, at the very least real estate investment can still be likened to stock market investment when it comes to looking for the best deal. An experienced stock market investor wouldn’t be buying too many stocks at once at the height of their investment when they have long-term goals and plans to keep on gaining profit with the same stocks. You may also see funding agreements.

You would want to follow the great Warren Buffet’s principle: When everyone else is fearful, it’s time to get greedy. You start to buy beaten down, forgotten stocks the rest have ignored and made money when they turn around. The same goes when you make your real estate investment. Don’t pay the price in “full” for properties you have set your sights on. You would want to look instead for what’s considered as “wholesale” properties with a price tag discounted at an all-time low. Yes, they might need some work doing and so you have to run and crunch the numbers then decide if the investment which would include renovation tasks would be worth the selling price. You may also see management agreement templates.

The people who are currently in office, our government or state officials want private investors to do their jobs in providing housing for the people because they would be held accountable and responsible for it otherwise. You may also see business partnership agreements.

Your average Jane Doe will always look and seem like a worthy tenant in the beginning. But you know what they say, heed this cliché-looks can be deceiving. Look deeper. Ask questions and evaluate your potential tenants. When writing your agreement, remember that it’s a serious deal especially because strangers are involved. Your potential tenants are technically strangers. You have to know who they are; their jobs, credit reports, and criminal records. You wouldn’t want to house people who have past run-ins with the law. A simple Google search might help you filter those who are applying for property leases and weed out troublesome tenants.

Real estate is business. When you’re in business, you can’t let yourself be moved to tears by a home with a great view or take one after another tenant with a sob story as your charity case. If you have decided you want the house you’re currently looking at or checking, you will, of course, find it difficult to make a sound, financial decisions but it is important to separate yourself from what you feel and not let good judgment be masked by emotions which often leads to a series of unfortunate events.

Once the honeymoon is over and things on the property or the tenant begins to look clear, you’d have to deal with major issues that could involve huge financial losses. Learn to look at realities. Listen a little to your heart, but always, always let your brain sound the loudest when making decisions. You may also see deposit agreement templates.

Before signing an agreement, you have to find out possible issues, especially if it is a purchase offer to avoid any disputes early on. Some people make the mistake of just signing anything without understanding and evaluating agreement clauses properly. When worse comes to worst, you would have nothing to back yourself with. You could end up with nothing at all before you even get to take advantage of what is supposedly a good investment. When in doubt, ask experts about the terms set after you have read them.

Don’t forget to include the two most important parts of the agreement which would be the property and its location. These should be written with an evaluation of the location, its legal allocations, and amenities, address as well as milestone fees because these are some of the most important things in the provisions which would make up a strong basis for the decision-making of whether or not to sign the agreement yet. You can also like partnership investment agreement templates.

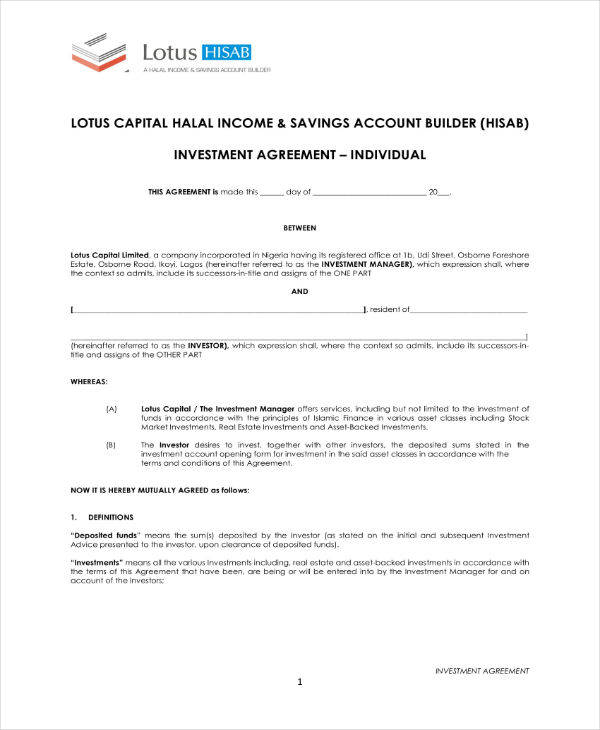

lotuscapitallimited.com